Printable PDF version

Subscribe to our newsletter

Wearable Computers & Construction

Are We There Yet?

California Tightens Energy Controls

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

Wearable Computers & Construction

If you think computers have become invasive, you ain't seen nothing yet! In this article we look at wearable computers, and how they may become part of our lives in the construction industry.

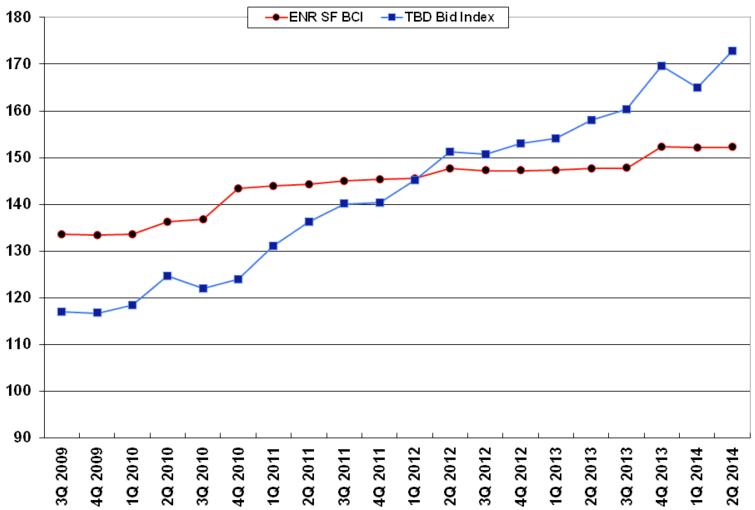

The construction industry took its beating from the Great Recession in 2009. Five years later and confidence in the recovery still wavers at times. Our TBD Bid Index is back up to the highs of 2007, but that discounts the way labor and material prices have continued to rise despite the recession, so in effect we are definitely not back to where we were.

Some regions in the nation are doing better than others. For instance, the San Francisco Bay Area is one region where construction has picked up noticeably, but even there contractors and subcontractors are still showing a reluctance to increase staff levels as much as they might, because they still have doubts about the strength of the recovery. The result is that bidders can be hard to find for some projects, as contractors have enough work to keep their existing staff going. Any project that appears onerous to bidders is likely to be by-passed.

The scarcity of contractors in a region experiencing a boom can be a benefit to those in nearby regions. As an example, contractors and subcontractors from Sacramento (where work is not so buoyant) are turning up on the lists of bidders for Bay Area projects.

When contractors do decide to increase their staff, sometimes it is not that easy, because people have left the industry and found jobs elsewhere. For instance, experienced site superintendents have become difficult to find in the Bay Area.

The Architectural Billings Index had been up for the first two months of the year, but dropped below its break-even point of 50, to finish in negative territory for March, at 48.2. That confirmed the belief that things were not completely back on track yet, although weather conditions may have had some part in the drop. Nevertheless, the idea of ‘making do with less’ has not only been affecting contractors, but has influenced commerce generally.

The recent improvements in the unemployment situation gives hope that things might be changing for the better, but economic growth projections for this year are still on the low side. In fact, the OECD recently reduced its projection for growth globally. The OECD’s latest predictions reduced anticipated growth in the US and China, while increasing expectations for Europe, but the prediction for European growth now stands at 1.2% vs. 2.6% for the U.S. But growth of any size is good, and revenue growth for contractors and design professions has been moving up for a number of years now.

Slow growth may indeed have some advantages. For one thing, it does give contractors and manufacturers opportunities to increase staff and ramp up production. That, in turn, should help to prevent dramatic increases in material costs and bid prices. Don't get too complacent, however, because history shows that markets seldom move smoothly for long. Rather they are known for dramatic swings up and down. How else can the markets make our lives interesting?

The public-sector was a major source of work during the recession, but has paid the price recently. Happily, the private sector has compensated nicely, and growth in employment and property valuations all add up to increased tax revenue that is helping the public-sector start to grow again. Funding for projects has been another sticking point, but even that situation is improving.

So we might still not be there yet, but we’re getting closer.

Geoff Canham, Editor

California Tightens Energy Controls

Energy efficiency is a major factor in building green, and in this article we look at the latest changes in California's Title 24 Energy Efficiency Standards, and some of the resultant construction cost effects.

Design consultant: Katie Levine of Vallance, Inc.