Printable PDF version

Subscribe to our newsletter

Living Building Challenge

Performance-Based Design

Financial PTSD

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

LEED has been highly influential in moving construction onto the ecological path, but there some that are trying to push the boundaries even futher. In this article we look at one of these alternates.

In this article we look at what Performance-Based Design is, how it is carried out, and how it can benefit a project.

The economy is back to chugging along nicely, unemployment is dropping, and while the stock markets are playing bouncy-bouncy, the upward bounces are regularly hitting all-time highs. So why is consumer confidence not rising faster, leaving retail sales lagging? The drop in oil prices has resulted in more money being left in people’s pockets, and economists were predicting that that would spur them to go on a spending spree, but that hasn’t happened.

It seems that the population is suffering a form of ‘financial post-traumatic stress disease’, and that has to be understandable. The Great Depression that started around 1929 sent shock waves through the population and left a generation that had a fervent distrust of financial institutions. Many literally preferred to keep their money under the mattress rather than risk putting it into a bank, let alone lend it to some businessman by investing money in the stock exchange.

The Great Recession pales in comparison to the Great Depression, but it has still been the deepest and longest lasting financial turmoil that the current population has experienced, and many are still feeling the effects. The lack of significant wage growth is one issue that gets mentioned regularly in financial reports, along with the fact that many of the employed are only in part-time jobs or otherwise under-employed. When someone is still not earning as much as they were before the recession hit, it is hard to convince them that the recession is over.

Consequently we end up in a chicken-and-egg situation. Domestic consumption accounts for about 70% of the US economy. With the US economy being so consumer-driven, and consumers fearing to spend because the economy isn’t picking up fast enough for them, it is little wonder that the recovery has been struggling. And that hasn’t been happening only in the US of course. Europe has been slower with their recovery, and still has many problems on their plate. The UK has just dropped into a deflationary period for the first time since the 1960s.

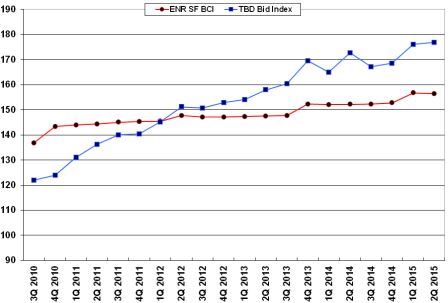

The slow recovery might have been good for construction in some ways. The recession hit the industry hard, and a lot of construction workers have left the industry, sometimes moving into other professions, sometimes leaving the country or simply retiring. The March 2015 report on the Architectural Billings Index (ABI) mentions that there are now 1.5 million fewer construction workers than at the peak of last construction boom around 2007, and an article on TheAtlantic.com says that Nevada currently has 60% fewer construction workers than it did during the boom. With construction work increasing again, this has resulted in shortages of construction workers across the US.

The main areas of construction growth appear to be in those regions where the hi-tech industries are located, and a recent article in the San Francisco Business Times spoke of the difficulty in finding qualified construction labor, and also reported on material shortages. Those material shortages had been exacerbated by the port strikes on the West Coast, but also relate to the manufacturing industry having to catch up with construction growth and changes in legislation regarding things like energy conservation techniques that require newer types of light fixtures, for instance.

Single family housing is the area of construction that still must make a serious recovery. This was the first area to go into decline and is the last one to pull back out. It is also the one that made most of the headlines with the foreclosures and the effects those had on people’s lives. Add to that the amount of student debt that many potential first-time buyers now have, and the lack of demand does not seem out of place. The development of housing complexes for the 55+ age group seems to be continuing at a good pace, and the general consensus seems to be that the single-family housing market as a whole is set for increasing growth over the coming years.

With the new job creation we have been seeing, unemployment levels have been dropping back towards historical lows, which should start to accelerate the rise in consumer confidence again. Growth in the economy and consumer confidence tend to go hand in hand, and the summer months should see both of them moving in the right direction, bringing further relief to those still feeling the aftereffects of the downturn.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.