In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

www.TBDconsultants.com

Solar panels have been appearing on roofs all around us. In this article we look at some new ways that PVs are being incorporated into buildings, and what factors are affecting the growth of solar power.

In this article we look at the increasingly affordable and popular method for surveying new and existing buildings, and the different uses the technology is being put to.

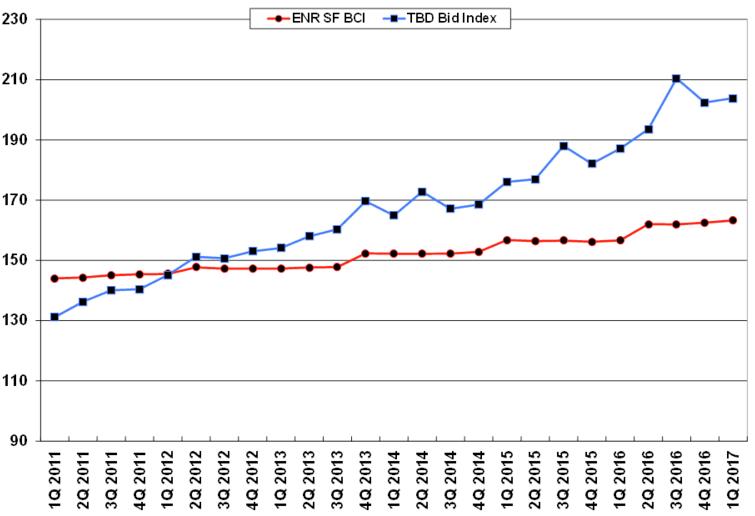

The markets are not supposed to like uncertainty, but they seem to be bucking the trend this time (writing at the end of February). The contentious election and a rather tumultuous start to the Trump presidency still leaves a lot of uncertainty as to how many policy decisions will work out, but the stock markets have been pushing to new heights, and that same confidence is being reflected in the construction industry. The Confindex quarterly readings continued to edge up as 2016 drew to an end and we entered 2017, including the Year Ahead Outlook Index.

It has been called the Trump Rally, but the markets had been pushing higher before the election as well. The plans announced by President Trump for loosening up some of the rules and restrictions governing business operations have certainly added to the rally, as has the talk of tax breaks. But the underlying confidence appears to stem from the fact that the economy has been showing steady growth for some time, and it is felt that the infrastructure initiative, etc., can only add to it. There had been some fears about trade wars disrupting growth, but it appears that a more measured approach is being followed. It seems likely that the stock markets will pull back soon, because valuations are already very high and fuelled by speculation that is likely to take longer to turn into reality than many hope, but that doesnít mean a new recession has arrived.

We still have to see how the infrastructure plan will be implemented, but it remains very much on the administrationís radar. Increases in growth would almost certainly advance the Fedís timetable for interest rate hikes, and that concerns a number of people, because we have become used to almost non-existent interest rates. But unless inflation really takes off, which it shows little sign of doing at present, we can expect any rate increases by the Fed to be small. Related to inflation is the potential impact of changes to immigration policies, because finding any staff, let alone qualified ones, is already proving difficult and expensive in the construction industry, and that difficulty and expense could multiply.

The potential dismantling of the Dodd-Frank legislation could be a great benefit to banks, and to other businesses as a knock-on, but the concern is that it could lead to a new financial collapse. It was, after all, put in place to prevent the kind of situation that led to the Great Recession, but again we have to wait and see if the regulations are simply tweaked (and most agree it needs some tweaking) or abolished.

When you look at the world as a whole, the US certainly shows up as a beacon of stable growth. Chinaís economy still seems to be slowing, Japan continues to have a stagnant economy despite Abenomics, India seems to have shot itself in the foot with its currency issues, and Europe is still trying to work out what is happening with the likes of Brexit and Greeceís debt problems. With Trump having investments around the world, we can hope that his administration doesnít become too protectionist and isolationist. Then, the growth we are experiencing could continue for some time.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.