In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

78 Heathervue, Greystones

Wicklow, A63Y997, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

The USGBC led the way towards a greener building environment, and the USRC is now trying to inspire safer buildings. In this article we look at the USRC rating system for how buildings respond to earthquakes.

Ransomware is the latest type of malware to make the news, and attacks are growing. In this article we look at ways to plan for building resilience into your computer networks.

At the time of writing (second week in August), the stock markets here and around the globe have been fluctuating as the war of words between the US and North Korea heats up. But the stock market is a leading indicator that had probably got too far ahead anyway, so even a substantial pullback would not be of much concern, and might be a therapeutic dose of reality.

The rapid rise in the stock markets had been fired by the promises of President Trump, but, as those got bogged down in the quagmire of modern politics, the markets still continued their headlong rise to record heights. The reason for the continued rise was the fact that the economy was, and is, doing very nicely despite (or some would say because of) the lack of clear direction out of Capital Hill. With that thought in mind, it is interesting to note that healthcare construction projects have been holding up well, and even increasing, despite the confusion over the future of the Affordable Care Act.

While the annual growth rate is not as high as many would like, and projections for the US have been revised down a bit by the IMF, they are still firmly in positive territory. Growth rates in the Eurozone and Japan have shown signs of picking up, which strengthens the prospects of trade and helps exports to these regions.

The US is now at a stage that historically would be called full employment, and more jobs are still being created and the unemployment rate continues to edge down. There are, actually, a lot of available jobs going unfilled simply because suitable applicants are not available, and the construction industry is being hit by that issue. With the low unemployment level, the surprising fact is that wage rates nationally haven't been increasing faster, but they are starting to pick up.

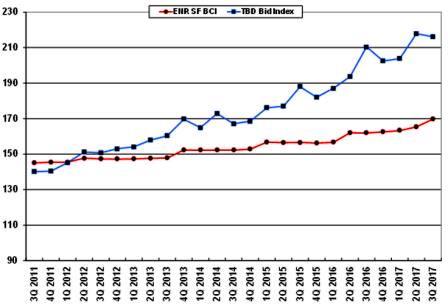

Finding suitable staff to meet the needs of construction sites and design offices has been a problem for some time, and is definitely not getting easier. The result is that contractors and subcontractors can afford to be very selective in what projects they want to bid on, so competition for work is becoming almost non-existent, especially where a project is in any way problematic. Examples of general contractors having difficulty interesting any subcontractors to bid for a particular section of work are very easy to find. This lack of competition has been allowing construction prices to rise, fueled partly by the contractors being able to demand a larger profit margin, but also driven by the fact that it is costing them more to attract and retain suitable staff.

Meanwhile, the demand for new projects continues, as commerce continues to give strong corporate revenue and profit growth, leaving large bank accounts that companies can invest in new and improved infrastructure. The Architectural Billings Index has remained in positive territory, meaning that there is plenty more work in the pipeline.

There is some concern being expressed about the stock market's climb, and a realization that it isn't going to last forever. The ongoing concerns about the Russia investigation, and the North Korea situation, have resulted in dips in the market, and more than likely will again. What the Fed does with interest rates, and how and when Congress will deal with the debt ceiling are other known concerns. The future will undoubtedly come up with new issues to worry investors, but for now the economy is proving to be extremely resilient.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.