Printable PDF version

Subscribe to our newsletter

What’s Next?

Robots in Construction

The Greening of Concrete

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

93 Moraga Way, Suite 206

Orinda, CA 94563

(415) 981-9430 (Orinda office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

4655 Cass Street, Suite 214

San Diego, CA 92109

(858) 886-7373 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

WeWork: Pacific Design Center – Red Building

750 N San Vicente Blvd., Ste 800 West

Los Angeles, CA 90069

(424) 343-2652 (Los Angeles, CA office)

1a Zoe House, Church Road, Greystones

Wicklow, A63 WK40, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

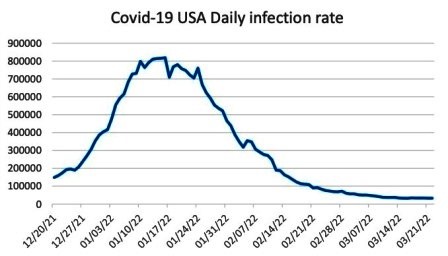

As Covid numbers turned down, it seemed as if we were getting back to something resembling normal. Then Russia invaded Ukraine and we were almost back to the 1960s with people concerned about nuclear war. The situation in Ukraine is tragic, and the mounting sanctions are having a serious effect on the Russian economy, but that only appears to be hardening Putin’s resolve. At least it looks as though China is resisting being brought in to prop up Russia and support their unwarranted aggression.

Of course, China is having its own problems, with widespread shutdowns as the Covid Omicron variant spreads across the country, giving its worst outbreak there in two years. Now we have Stealth Covid (Omicron BA.2) sweeping the world, and it can cause infection even if fully vaccinated, but in that situation the effects are normally mild and may not even be noticed.

With the interconnected world economy that we’ve grown used to since the end of the Cold War, people worldwide are starting to feel some of the pain as fuel and food supplies are curtailed leading to rising prices. Russia is a major supplier of oil and gas, especially to Europe, and Ukraine has been described as the breadbasket of Europe. Oil prices surged, then dropped back a bit due to talk of increased production by other OPEC members and the China slowdown reducing consumption. All of that is putting additional pressure on inflation and making the Federal Reserve’s job of managing the economy even harder. In hindsight, they probably should have started raising interest rates in 2021, but they don’t have a crystal ball and their decisions seemed logical at the time.

All of these issues are meaning that businesses are left with questions about the way the economy is headed. Those questions are making planning new projects a risky business, so many of those plans are likely to be put on the back burner until at least it seems as if we can tell what the future holds. Nobody likes using the word “stagflation” where inflation is high while growth is static or receding, but it is looking increasingly possible.

Construction work had been picking up as the pandemic showed good signs of fading into the background for real this time. The ABI had been showing growth for the 12 months through the start of this year, but the growth had been slowing as the labor and material challenges facing the construction industry continued to push up prices. The latest construction confidence index (CONFINDEX) was continuing to look positive, but that was immediately before the invasion of Ukraine. Material prices, supply chain delays, and skilled labor shortages showed up as the main problem areas. Contractors had a decent level of work backlog and continuing demand, which was leading to a decrease in competition while bidding. Now the Ukraine situation is causing even more disruption to the supply chain and, with the Fed expected to be pushing interest rates up on a regular basis to fight inflation, the availability and cost of financing will be adversely affected.

On the positive side, the US has the biggest economy in the world and a large portion of its gross domestic product comes from internal consumption, so we are likely to feel less effect than many other regions around the world. The infrastructure bill should also keep the workload up for many, even if it exacerbates the labor shortage. We will still see growth in facilities to support the aging boomer generation and apartments to accommodate the millennial and Generation Z, along with warehouses to facilitate the growth in online shopping.

Geoff Canham, Editor, TBD San Francisco

In this article we look at what robots can do for the construction industry, and how that will help the staff shortages that contractors are experiencing.

Concrete has been identified as serious contributor to greenhouse gasses, and here we look at how its impact on the environment can be improved.

Design consultant: Katie Levine of Vallance, Inc.