Printable PDF version

Subscribe to our newsletter

Is AI After Your Job?

Rebuilding the Mall

Recession Receding?

Construction

Management Specialists

San Francisco, CA

(415) 981-9430 (San Francisco office)

Orinda, CA

(415) 981-9430 (Orinda office)

Rocklin, CA

(415) 872-0996 (Sacramento office)

San Diego, CA

(858) 886-7373 (San Diego office)

Redmond, WA

(206) 571-0128 (Seattle office)

Los Altos, CA

(650) 386-1728 (South Bay office)

Los Angeles, CA

(424) 343-2652 (Los Angeles, CA office)

Wicklow, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

AI has been making headlines again recently, and here we take a look at how it is likely to affect design and construction.

Online shopping, followed by Covid, has had serious effects on shopping malls, and we take a look at how malls are adapting.

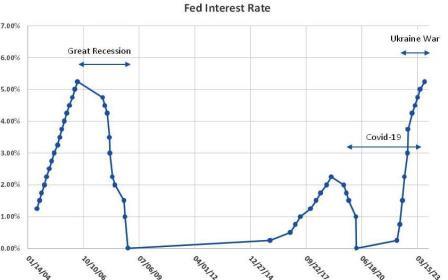

In early September, Goldman Sachs reduced their odds for a recession occurring in the near future to 15%, about the same odds that you might expect anytime, and others including Bank of America and the Fed seem to agree with that kind of assessment. Recession has been talked about for a long time, but business has been thriving despite the Fed's interest rate increases. Those increases may have helped bring inflation down somewhat, but oil prices are threatening to put pressure on again, rebounding 20% as Saudi Arabia and Russia cut production and then the flooding in Libya also disrupted exports from there. Fuel increases don't directly affect the Fed's favorite inflation index, but those increases will be weighing on consumer confidence.

The current pause in rate hikes seems to be allowing time for the Fed to see what effects its increases to date are having, because it takes a year or so for rate increases to work through the economy. We have been going through unique times since the pandemic, and now have a cooling but still strong US economy. The Fed's last increase was in July, rising by 0.25% to a 22-year high, but they held rates steady in September. These high interest rates have companies focusing on profitability rather than growth and have been laying off staff. The question is now less on how many more increases there will be but how long rates will remain this high.

The Eurozone slipped into recession in June but seemed to be pulling up. US GDP has been holding up well, which doesn't look like a recession. Consumer spending has remained robust but is getting more selective, and there are headwinds (e.g., student loan payments resuming). Also, Macy's has been reporting that customers are increasingly failing to make credit card payments, so growth prospects are slowing. But the US economy is proving more resilient than the Fed might have hoped for.

Our sticky inflation has been driven by demand, with consumers making up for lost opportunities during the pandemic, but it is unclear how much longer consumers can continue their buying spree. Core PCE (Personal Consumption Expenditure, which excludes volatile food and energy costs) showed a year-on-year 4.52% in May, 4.09% in June, and 4.24% July, while the Fed's target is 2%. Meanwhile, wages aren't keeping up, and wage negotiations concern the Fed because they can build in inflation. Job growth has been dropping, but not fast enough for the Fed. Actually, the initial count of job growth for August was 187,000 while the average pre-pandemic job growth was 183,000 per month.

One possibility, instead of recession, is known as stagflation. That is when we have a slowing or stagnant economy, but inflation stays high, and it's something central banks can't do much about. Everyone hopes to avoid this, but it remains a possibility, but currently more so for Europe than for the US. What everyone hopes for is a soft landing, which would mean that we get a cooling but still strong economy. That happy outcome is now looking more possible as the economy cools slowly, and inflation hopefully continues to drop lower, but it seems to be in no hurry to come down. Some have suggested that what we have been experiencing is a rolling recession. Manufacturing has been through a recessionary period and other sectors may be following, one-by-one.

Not that there aren't potential dangers out there. Fitch downgraded the US debt rating to AA+ from AAA based on "a steady deterioration in standard of government", citing the debt ceiling issue that came close to shutting down the government, and at the end of September the issue got kicked down the road another 45 days, so we'll be facing it again around the time you get to read this. Corporate bankruptcies have been rising, and regional banks are still showing signs of stress. Disputes with China over the future of superconductors could hit many companies hard, and the Chinese economy is facing tough times that seem likely to spill over into the global economy. And now there's the surprise Israel-Hamas war.

Meanwhile, extreme weather has been starting to affect the economy. We have seen cancelled flights, closed businesses, lack of rainfall affecting the Panama Canal is adding to supply chain difficulties, and we are seeing less productivity due to excessive heat. However, storms and fires have been leading to more construction work - and that's a good thing, right? Well, living in an area that's been evacuated three times in recent years, I'd be reluctant to say that. And I've learned to expect the unexpected.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.