Printable PDF version

Subscribe to our newsletter

Oiling Inflation

GMP Negotiation,

Part 1

Construction Scheduling 101

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

www.TBDconsultants.com

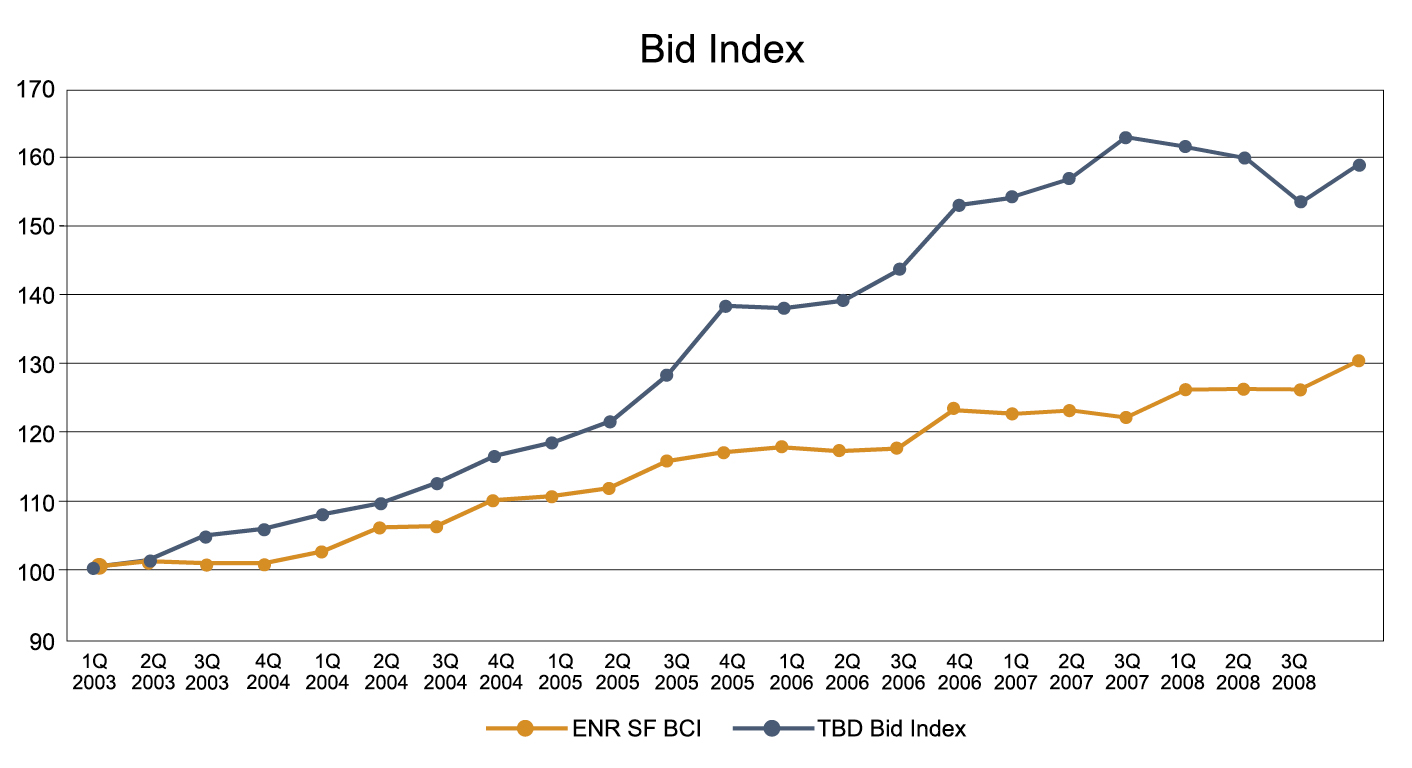

The latest round of labor increases and the rise in steel prices (which are backtracking at the time of writing) have reversed the falling trend in our Bid Index, at least in the short term.

Rising oil prices have also been driving up prices across the board, and hindering the effects of increasing competition. In this article we will look into what is driving the oil price rises that we have been seeing, and look at some of the effects we are likely to see in the future.

Back in the 1960's some doom-sayers were claiming global oil supplies would be drying up within 20 years. That obviously did not happen, but the predictions were based on the then-known exploitable oil reserves and the way oil consumption was increasing.

Then we had the first oil crisis, resulting from the Yom Kippur war and the Arab oil embargo of 1973, which resulted in the price of a barrel of oil more than tripling, and stemmed the rapid increase in oil usage. That price increase also made more oil sources viable, and also spurred the search for more oilfields. The second oil crisis, around 1980 (resulting from the Iran-Iraq war), had oil prices more than doubling, but new fields were brought on stream and demand continued to falter, with the result that by 1986 oil prices had fallen below the rates they had been in 1978.

However, oil remains a limited resource. Twenty years ago there were fifteen oilfields that could produce over 1 million barrels/day, whereas today there are four. It appears that crude oil production peaked in 2005 (US oil production peaked around 1970) and since then world oil production has remained around 73 - 74 million barrels a day (New Scientist magazine, 28 June 2008 edition). Oil consumption is now about 87 million barrels per day, with the difference between production and consumption being absorbed by use of liquefied natural gas and dipping into oil reserves. The growing economies in Asia, Africa and the Middle East are pushing demand for oil, while US oil usage is declining slightly.

Oil companies are still doing their best to meet demands, including squeezing more out of dwindling wells (and even ones previously considered exhausted) by pumping carbon dioxide into them to eke out more oil, but the International Energy Agency predicts serious supply concerns after 2011. There is also the fear of terrorist activity disrupting supplies, and making recent price raises pale to insignificance. As an example, Iran threatened to block the Strait of Hormuz if it is attacked, and about 40% of the world's oil passes through there.

70% of the oil in the US goes for fueling cars and other vehicles, the remainder of the oil being for things like heating, fueling industry, and the production of plastics as well as many solvents and pharmaceuticals.

So, what are some of the alternatives to the use of oil?

Hydrogen has long been suggested as an alternative fuel for vehicles, but it has storage problems and has not seen much adoption yet.

Solar/PV power sources have shown about a 15% increase between 2003 and 2007, and while they currently provide less than 1% of US electrical power, by 2030 that could be up to 10% or more.

Wind power has shown about 190% increase between 2003 and 2007, and it has been suggested that it could provide 20% of US energy by 2030.

Wave power is another option, but hasn't seen much use yet.

Biofuels have been blamed for taking away food-producing land, but they can also use biological waste from food production, effectively using the same land for two purposes.

Geothermal energy is limited to suitable geologic regions, but has shown about a 5% increase between 2003 and 2007, and its adoption is now increasing.

There are likely to be some infrastructure changes as we wean ourselves off of oil dependence, including a push for high-speed rail and light-rail systems, partly replacing fuel-inefficient air travel and inner-city automobile traffic respectively.

GMP Negotiation, Pt 1

Matt

Craske

Continuing our look at the GMP delivery method, we move onto the stage of the GMP negotiation.

Construction Scheduling

101

Michelle

Tobias

In this article we take a look at the ingredients of a construction schedule and the use of construction scheduling software.

Design consultant: Katie Levine of Vallance, Inc.