In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

806 West Pennsylvania Ave.

San Diego, CA 92103

(619) 550-1187

www.TBDconsultants.com

Recession!

Geoff Canham, Editor

What officially is a recession, what is the recession doing to our Bid Index, and how long is it likely to last? We look at some of these issues here.

Market & Escalation

Gordon

Beveridge

How is the recession affecting different sectors of the construction market, and how is escalation (or lack of it) likely to behave over the coming years? Gordon discusses these issues here.

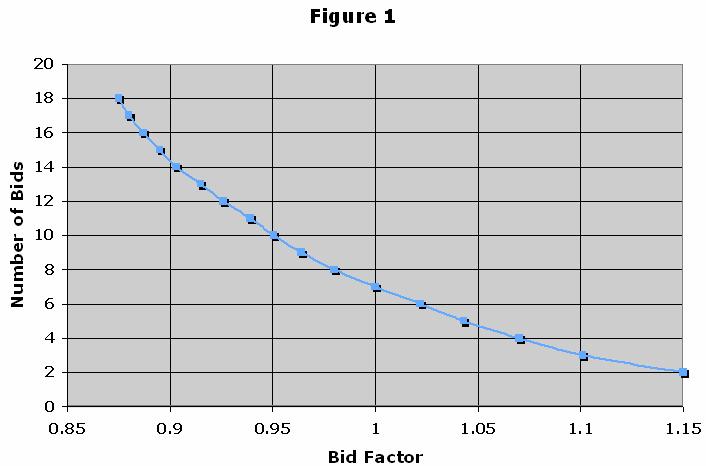

With the recession starting to affect the construction industry, the increasing competitiveness of bidding conditions is becoming more apparent. In a "normal" market (which we haven't seen for a while) one would expect around seven bona fide responses for the majority of projects. Currently however, it is not unusual to receive far more than that, and the statistical chances of receiving a competitive bid increases with the number of bidders. Figure 1 illustrates how the number of bidders affects the level at which bids may be received.

This index was prepared by Hanscomb Associates (a company that features large in the history of TBD Consultants) using a database of more than 2,000 bid results over a seven-year period. The analysis of the data revealed a distinct correlation between the number of bids received and the pre-bid estimate. While individual bids might deviate from this curve for various reasons, the index can be used as a tool for adjusting the pre-bid estimate by using the probabilities of likely price changes according to the number of bids.

The relationship between number of bidders and the competitiveness of bids is not a direct causal one, but rather the fact that both tend to be the result of the same market forces. A busy construction market will tend to mean less contractors are interested in bidding for a particular project, and those bidders are likely to bid high because they do not really need the work. In recessionary times, almost all contractors in the area, and some outside of the area, are likely to be chasing a project and trying to undercut each other.

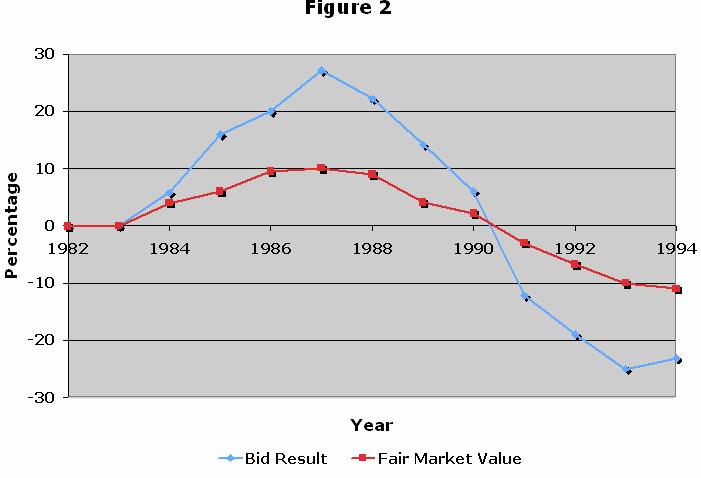

What we were describing as bids in a "normal" market has also been described as the "Fair Market Value", and another study by Hanscomb Associates addressed the way actual bid results deviate from the Fair Market Value as markets moved through boom and recession.

Estimates are built up to include the labor, material, equipment, site overhead, office overhead, profit, and supplier and subcontractor discounts. Since it is hard to predict exactly what the bidding market will be at the time an estimate is prepared, they are normally developed to reflect a reasonable return to a contractor for his output, equipment and profit return, i.e. to show the Fair Market Value.

The Hanscomb study tracked a number of budget to bid relationships over a period of more than a decade, as the market changed. The 0% line is where prices would be if all things remained equal. The Fair Market Value line takes into account changes in material and labor costs (adjusted for escalation). The Bid Results line incorporates the effects of "predatory pricing", either aiming for the best possible price in good times, or trying to undercut the opposition in bad times.

The resulting graph (Figure 2) initially shows the same trend that the TBD Bid Index has been showing since 2003, and we can only hope that the construction market recovers a bit quicker than it did in this illustration.

The point though, is that the "right" price for a project is always the one that the market can bear, which is frequently not the same as the Fair Market Value. In good times, when contractors have as much work as they can handle, they can afford to put in high prices. When times are tough, and new projects are fewer, contractors have to bid lower to win a project, reducing profit margins and even discounting some of their overhead.

One side effect of this is that contractors have more incentive to pursue claims, to help make up for some of their reduced margins. Consequently it becomes even more essential to ensure that contract documents are complete and coordinated, to minimize the opportunity for claims.

Design consultant: Katie Levine of Vallance, Inc.