In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

806 West Pennsylvania Ave.

San Diego, CA 92103

(619) 550-1187

www.TBDconsultants.com

Market Update

Gordon Beveridge

At the time of writing (mid June) the Stock Market is starting to drop again, but generally it has been showing a determination to rise, even if ever so slowly. The same cannot be said for the construction market.

The latest unemployment ratio in some trades has hit 20% or more. This is almost double the general unemployment rate of the entire workforce and illustrates how badly the construction sector has fared in this recession.

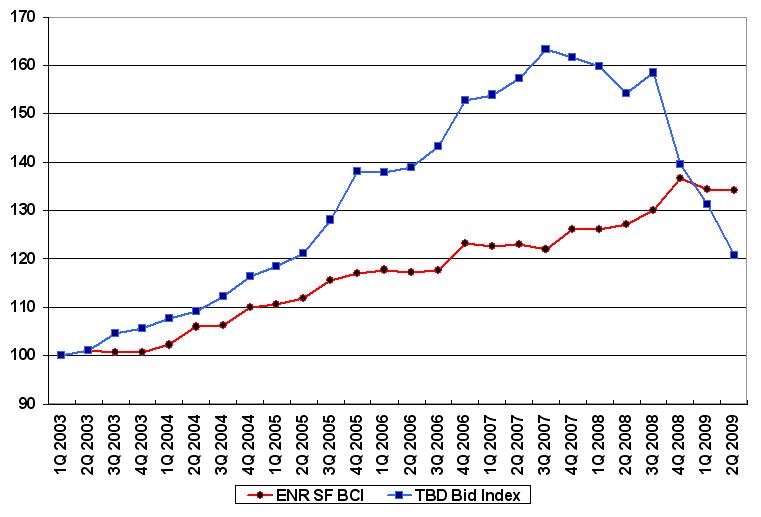

Based on bid results in the past couple of months, the market for General Contractors and especially subcontractors has moved to a market of desperation. There has been a stampede of contractors willing to compete in the already crowded public sector with the winner takes all mentality. The “winners” or low bidders in many cases are 20-40% below the market of only six months ago.

However, procurement methods will dictate to some extent just how low the bids from General Contractors will go. In the highly competitive Public Sector Lump Sum Bidding, where winner takes all, bids have been coming in 30-40% below the market rate of the fall 2008. Dissect a little into this market and we have found a large number of subtrade bidders (not unusual to have 6-10 bids for each trade) with a very large spread of bids (lowest to highest in the range up to 100%).

In this arena the low sub bids have little margin or possibly negative margins to secure work and hopefully keep or hold their core workers until the market recovers. A serious concern for owners will be the threat of default or lack of performance as the chickens come home to roost and the market continues to languish.

There are clear warning signs of trouble ahead and owners will be well advised to hold some of the money saved on bid day in reserve to cover for the fallout of any defaulting contractor.

In the more cautious world of the CM/GC there is certainly fierce competition on General Conditions and Fees, however there is a much more measured approach to the subcontractor bidding market. Many of the CM/GC’s have done their own estimates and can detect bids below the reasonable market value. They typically are not obliged to take the low bid if they consider it to be below the reasonable market value. They will also be more selective as to who will be allowed on their bidding list. In this world of CM/GC we would still anticipate the bids to be 15-20% below the market of last year.

Going forward we do not see the market improving in the short term (3-6 months). Owners will continue to be surprised on how low bids are versus budgets. These pleasant surprises will be tempered against the inevitable problems on site as contractors struggle to perform and survive when time and the market is not on their side.

Will the stimulus make an impact? The short answer is yes there will be some impact, especially with the infrastructure market; however, it is difficult to see a major impact on most companies. It may help to save current jobs, but difficult to see the package creating new construction jobs.

What will LEED Cost?

Oliver

Fox, LEED AP

You want to be kind to the ecology with your new or renovated building, but what is it going to cost you? In this article Oliver addresses the issue of costs associated with achieving a LEED certification.

This is the second in a two-part article looking at the issues surrounding GMP negotiation, in our continuing series on the GMP procurement method.

Design consultant: Katie Levine of Vallance, Inc.