Printable PDF version

Subscribe to our newsletter

Construction Cost Trends

What influences the steel market?

Office 2010 Arrives

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

4361 35th Street

San Diego, CA 92104

(619) 550-1187

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128

www.TBDconsultants.com

Construction Cost Trends

Brian Tolland

The stock market continues to climb slowly up, but construction remains flat. Brian Tolland looks into where we are now and what we can expect the construction market to do in the coming months.

What influences the steel market?

Oliver Fox

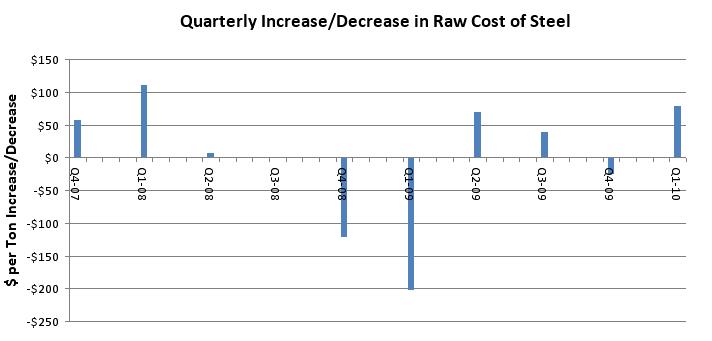

Steel, along with copper and aluminum, are the high profile metals that the construction industry is compelled to track. In the past two years we have seen installed prices for steel structures peak at $4,200 a ton (for wide flange) in mid 2008, and then plummet to $2,300 a ton at the end of 2009. Of course this is a range and depends highly on the size and functionality of the building. For example, currently an office building is approximately $2,300 - $2,500 per ton whereas a hospital facility is around $2,500 - $3,200 per ton.

According to Engineering News Record (ENR) steel prices fell 5.6% in 2009 and forecasts 2010 to be another tough year with a 4.8% decrease. At TBD Consultants we have seen installed steel prices remain consistently low for the past three months with subcontractors cutting their fee and profit to get the job.

Bob Hazelton, Vice President of Herrick Steel, points out that “anyone claiming knowledge of steel prices for the rest of the year doesn’t know what they are talking about”. What we do know is that the longer the recession continues the higher the chance of fabricators going out of business and lowering the production capacity.Bob Hazelton, Vice President of Herrick Steel, points out that “anyone claiming knowledge of steel prices for the rest of the year doesn’t know what they are talking about”. What we do know is that the longer the recession continues the higher the chance of fabricators going out of business and lowering the production capacity.

So what influences the cost of steel?

Demand for scrap metal (approx $300 - $600 ton) is the start of the food chain and any increases due to supply and demand are passed onto the large mills like Nucor & ArcelorMittal, who naturally pass it onto their customers. Global demand has resulted in scrap exports to Europe and Asia in the past. Since post consumer recycling is the primary source of scrap, there is a natural migration from developed industrial markets to emerging markets. Turkey and China are major importers of scrap to feed electric arc furnaces.

The second influence is energy prices. When oil was $145 a barrel in mid 2008 this had an effect on most aspects of the steel industry. Mills use a lot of energy to power the electric arc furnace that melts the scrap and casts it into semi-finished slabs, ingots and beam blanks. Reheating the semi-finished products so the steel can be rolled into plate, tube and wide flange also requires a lot of energy. Then fabricators such as Herrick, use energy to cut and weld the steel for a particular job. Finally, although not a big cost percentage-wise, there is the transportation to site which is affected by gas prices.

The last major influence is market conditions and capacity utilization. Three years ago, when demand was at its peak, some fabricators were running three 8 hour shifts and still demand couldn’t be satisfied until new facilities came online. For some of the larger projects steel delivery times were too long to fit the project schedule. Accordingly the result was more imported steel from abroad. Some would argue domestic capacity was sufficient and the import of fabricated steel was related more to cost than schedule.

In the current recession capacity is being reduced as more fabricators struggle to break even, this increases the likelihood of steep price hikes when the economy does recover. There are other factors that increase or decrease the cost including detailing and sophisticated modeling for example but the three areas mentioned form the major three.

The outlook for 2010 in construction looks challenging, which means steel bids will probably continue to be low and very competitive for the first half of 2010. The latter part of the year looks to be similar, however no one expected the steep increases in 2004 and commodity prices can be very volatile. China remains the dominant supplier and consumer of steel with the ability to stockpile if required and control the price of steel to take advantage of the global market.

Geoff’s IT Gems

Office 2010 Arrives

When Office 2007 arrived it was a major change from its predecessors. Now Office 2010 is about to arrive at a computer near you, so what differences can you expect this time?

Design consultant: Katie Levine of Vallance, Inc.