In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

9705 Cymbal Drive, Vienna, VA 22182

(415) 981-9430 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

The Steel Market

Steve Sacks & Sam Evison

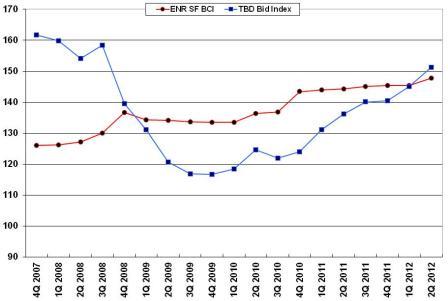

The way steel prices are moving is often a leading indicator to the way other construction material prices will go. In this article we look at how steel prices are moving and what is driving them.

The tablet format has been around for a long time, but it is only since the introduction of the iPad that it has really taken off. Here we look at some of the advantages and some of the problems when uses tablets at work.

Beware – Cliffs Ahead

Geoff Canham, Editor

It was two years ago, in our 2010 Q3 newsletter that we wrote about the economic problems associated with Greece, and those problems have not gone away. Indeed, with the political changes that have occurred there, the problems have only compounded. But while Greece may be the chief headline grabber in Europe, it is far from the only one, with Spain and Italy following close on Greece’s heels, and France, with its change in leadership, is grabbing more of the headlines as well. And next year, Germany Prime Minister Angela Merkel faces national elections too.

So the problems of the Euro appear to be coming to a head, and the time for kicking the problem further down the street may be coming to an end. In essence, the problems with the Euro stem from having a single currency that is being used by many different countries, each with its own economic and political systems, with varying productivity levels, and no easy way of adjusting the currency’s value between nations. Back when they had separate currencies, as Greece became non-competitive it could have devalued its currency, making its goods and services more attractive to other nations. That cannot happen now. The members of the Eurozone cannot now use their currency as a tool for managing their economy.

What we are left with is the option for Greece to opt out of the Euro (and no one seems to be sure how that would work, or even if ‘work’ is the right word to use), or to have the more productive nations (primarily German) support the less productive ones (and that does not sit well with Germany). The real solution is the integration of monetary and fiscal policies throughout the Eurozone, but that takes away sovereignty from individual nations, which is unpalatable to most people. The idea of using austerity to bring the nations back in line is being questioned by many, especially those who are directly impacted by it. Exactly what the long-term solution to the problem is remains to be seen, but in the meantime the uncertainty is rattling the markets, and creating a business atmosphere where investment is seen as more risky. Uncertainty and recovery may not be totally incompatible, but they do not fit well together.

The problems of Greece and the Euro constitute one cliff we have to look out for, but there is another one, specifically the one that gave us the heading for our article.

Here in the U.S., the recovery may be slowing down, but generally it is still moving in the right direction at present. But the debt issue is still out there, and unless the politicians can agree on an alternative plan for addressing the problem, massive government spending cuts will be automatically triggered, raising the specter of austerity here. As the result of the battle in Congress that led to S&P downgrading the US credit rating, come January 1, 2013, if Congress has not agreed an alternative method for controlling the US debt, then $7 trillion in tax increases and spending cuts, spread over 10 years, will automatically spring into effect. Federal Reserve Chairman, Ben Bernanke, described that as a ‘fiscal cliff’, and expressed fears that it would result in the U.S. being pushed back into recession. We can hope that the politicians at least come up with a last-minute compromise – a cliff hanger – as they did last time. Is it too much to hope that they could agree on a solution before the last minute?

Meanwhile, we chug alone and hope we are not heading for a cliff edge.

Design consultant: Katie Levine of Vallance, Inc.