In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

9705 Cymbal Drive, Vienna, VA 22182

(415) 981-9430 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

The Steel Market

Steve Sacks & Sam Evison

Gone are the days when steel was a relatively stable commodity. For decades, a swing in steel prices meant a change of a few pennies a pound in rebar pricing spread over weeks rather than days. This is no longer the case – price changes are now much more volatile.

Following a sustained decline, the construction market has been dormant for some time, with material costs / unit rates remaining relatively stable for most trades. The exceptions have been trades linked to commodity materials such as copper and steel.

The in-place unit rate for conventional structural steel framing is now above $4,000/ton (up approx. 20% in the last 12 months) and it is possible that this trend will continue through 2012 with no immediate sign of these increases flattening out.

It is safe to assume that the only predictable thing about the steel market in the near future will be continued price volatility.

The current global supply and demand forces for steel have meant that price swings are more pronounced and frequent with no sign of this trend changing anytime soon. Commodity price volatility appears to be the new reality for the construction industry. This is a trend to which the industry will need to adapt as we approach what people hope to be a sustained recovery in business activity.

Signs of this new trend in volatility for steel pricing became evident back in 2010 - in mid-November of that year carbon steel sheet pricing shot up 27 per cent in a five week period. Scrap steel prices also increased rapidly, with steel mills that produce rebar scrambling to increase their prices fast enough to cover their rising input costs. Overall, rebar pricing increased 25-30 per cent over that very short period of time, and the same factors resulted in a corresponding increase in price for structural steel shapes. This general trend continued through 2011.

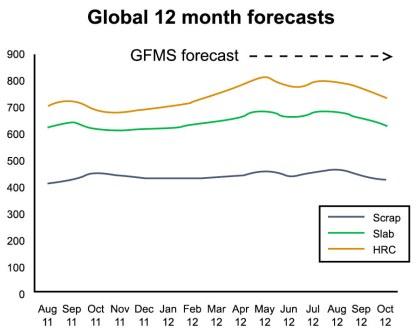

GFMS Ltd., a leading independent precious metals consultancy that specializes in market research, states that they expect to see increased cyclical volatility as a persistent condition in the market – the current recovery in steel prices could continue over the course of this year and next, but prices could equally fall back to the lows of 2010 as well. The problem for anyone buying steel products is timing – buying early may avoid delays related to mill rolling schedules, but the decision is difficult if short term market trends are unclear - will steel be more or less expensive in 12 months?

Historic pricing trends indicate that from 2003-2008 the duration of the average pricing cycle ran around one year, with a minimum cycle of 10 months. Before 2003 pricing cycles ran 18 to 36 months or more. Steel prices have experienced meaningfully increased volatility in the past 18 – 24 months with a new trend appearing which has two intact cycles within that time. The period from November 2010 until early to mid 2011 saw a 30-percent up cycle and was followed by a 20% down cycle during the third quarter of 2011, the calendar year for 2011 ended part way through another up cycle resulting in a 20% annual increase. The same up cycle has steadily continued until now. Does this suggest that the steel market may be close to starting a down cycle which would see prices drop at some point during the 2nd half of 2012?

Global Steel Mill Price Forecast – Q2 & 3, 2012

World prices - scrap, steel slab, hot rolled coil (GFMS, 2012)

The principal reason why this market volatility is likely to persist in the future is the empty supply chain. Inventories at the mill, distributor and consumer levels normally cushion the market for small swings in steel demand, seasonal swings, supply chain disruptions and other nominal increases / declines in orders. However the supply pipeline has been effectively empty for an extended time now, and some capacity has also been lost during the recession. This means that lead times for production of specific steel products still exist, and increases in demand cannot be instantaneously satisfied. This pricing environment indicates that if you need high quality steel installed by high quality contractors with a short lead time then there is a premium involved, if in fact the schedule is realistic.

This situation may currently be more evident in the Bay Area market than on a wider geographic basis, but as steel sub-contractors refill their order books (or hold capacity for future work) this increases the upward pressure on costs for future projects. With UCSF Mission Bay Hospital, San Francisco General Hospital and the Transbay Transit Center all under construction, and plans in the pipeline for a new San Francisco 49ers stadium, San Jose Earthquakes stadium and a new Apple Headquarters, much of the capacity within the steel sub-contractor sector will be absorbed.

These large projects will tie-up the larger sub-contractors capable of such work, leaving medium sized projects in an unfavorable bidding climate, with limited bid competition and many of the best subs absent from the pool of available bidders. Limited competition will of course also allow bid prices to rise.

Given the probability that most if not all of these larger projects will go ahead, likely with overlapping schedules, it is prudent to assume that the underlying upward trend in prices for steel products will continue in the short to medium term.

What about foreign steel?

In theory the freedom to import foreign steel should have a moderating influence on domestic prices. In practice there are a number of issues that dampen this effect. In the past the steel industry has been successful in lobbying for tariffs on imported steel, although these are typically applied selectively - for instance, from March 2002 to December 2003 the Bush Administration placed an 8% - 30% tariff on selected imported steel products, but there was no tariff on structural steel shapes, and only a 15% tariff on imported rebar. These tariffs were ultimately removed due to international pressure and the threat of retaliatory tariffs on US exports.

The use of foreign sourced steel is precluded in public works funded with federal money by the ‘Buy American’ clauses in federal contracts.

Use of foreign steel also introduces the question of certification and quality control, particularly where raw material is being fabricated into finished products overseas.

So while foreign steel mills may provide a source of raw material, they don’t necessarily provide a quick easy solution for all projects.

What about out-of-state sources?

Out of State steel fabricators provide a source of additional capacity, and/or expertize to the Bay Area construction industry. Depending on the state of their local market, they may introduce an increased level of competitiveness to an otherwise overheated Bay Area market. They also introduce potential complexities to a project based on their distance from the project site, additional transportation time and costs, and potentially the need to partner with local erectors.

The tablet format has been around for a long time, but it is only since the introduction of the iPad that it has really taken off. Here we look at some of the advantages and some of the problems when uses tablets at work.

Beware – Cliffs Ahead

Geoff Canham, Editor

The markets have certainly been volatile recently, but business activity still continues its slow climb out of recession. What are the potential danger zones ahead? Here we take a look at a couple of them.

Design consultant: Katie Levine of Vallance, Inc.