In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

Drones, or Unmanned Aerial Vehicles, are being seen buzzing around the skies fairly commonly these days. In this article we look at some of the implication of their use, and the kind of roles they are finding in construction.

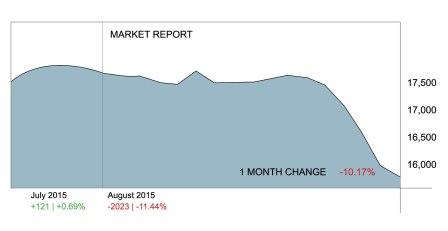

ĎMay you live in interesting timesí is said to be an old Chinese curse, although no one has ever proved the saying came from China. But China has been making life interesting in the field of world economics, with its stock market gyrations and its snap currency devaluation, both stemming from the slowing down of its economy. The currency devaluation only amounted to a few percentage points, which was not dramatic as far as currency changes go, but it will make selling goods and services to China a bit more difficult. The question of just how bad Chinaís economy really is finally brought the long awaited correction (or 10% drop the recent high) to the US stock markets, as show in the following chart from CNN:

Similar falls occurred with stock markets around the globe. It has been suggested that Chinaís real growth rate is down to 2%, rather than the 7% claimed by the Chinese government, but 2% is still not bad compared to many other countries.

Greece got a last-second deal, although they might not have thought it was a great one. They basically conceded to everything that was being demanded of them, and further damaged their economy by holding out so long. At the time of writing this article (end of August), Prime Minister Alexis Tsipras has resigned and a new general election is expected, probably before this newsletter goes out. And the IMF has been pushing for debt-relief for Greece, which most nations in Europe donít support for political reasons, so the Greek saga will be on-going. Exactly what Europe and the Euro will look like at the end of it all is still open for speculation. But despite all that was going on, the Greek economy actually grew by 0.8% in the second quarter.

Oil prices continue to drop while OPEC, the U.S., and other oil producers keep pumping more and more, waiting to see who blinks first. All sides are suffering of course, with some bankruptcies and mergers expected among US shale oil producers, and even Saudi Arabia is having to borrow money to balance its budget. And Russia is wilting under the combination of sanctions and the oil price drop.

It has been said that the main purpose of financial forecasting is to make astrology look good, but since I might have a chance to correct it before the newsletter gets published, I will predict that the above issues will be sufficient to deter the Federal Reserve from touching interest rates in September. But the question of when the Fed is going to start increasing rates is another issue that is creating uncertainty among investors, so it will be good when some clarity is presented as to when the move will occur.

The effects on the market at the end of August have shown that when China catches a cold, the rest of the world, including the US, at least sneezes. That said, the US economy is still progressing nicely, although still not as well as most would like. Wage growth remains below the Fedís target, but moving in the right direction, and consumer spending doesnít appear to have gotten the boost from the drop in gas prices, so inflation remains very low. Unemployment continues to drop and the economy is still moving upwards, despite the head winds.

Geoff Canham, Editor

The construction cost of a new building, or a building upgrade, is a substantial investment, but it can pale in significance when compared with other costs incurred during the life of the building. Here we take a look at a procedure for including these life-cycle costs when assessing the value of a construction project.

Design consultant: Katie Levine of Vallance, Inc.