In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

Drones, or Unmanned Aerial Vehicles, are being seen buzzing around the skies fairly commonly these days. In this article we look at some of the implication of their use, and the kind of roles they are finding in construction.

The slowdown in the Chinese market led to a record points drop in the Dow, and here we look at the implications of this and other worldwide events on the US market.

The initial capital investment in a construction project is substantial, but that investment is only a portion of the total cost of the project over its life. Stanford University estimates that the initial project cost of one of its new buildings comes to only 58% of the costs involved with the building over its anticipated 30-year life. The 58% included the soft costs (design fees, permits and other owner costs) that typically add up to about 30% of the project cost, so the actual construction cost portion becomes about 45%. That life cycle analysis included Utilities, Maintenance, Service, and System Replacement, but excluded the cost involved with the people actually using the building, which can be the largest cost element of them all.

Life cycle cost analysis of a complete building is an interesting exercise, and can provide useful information for making cash flow projections for the maintenance of the building. However, life cycle cost (LCC) studies are more normally carried out to compare alternative designs for elements within a building, to assess which offers the overall best value. Alternative HVAC systems, or alternate designs for exterior glazing, are the kind of instances where LCC studies are commonly carried out. LCC is often performed in conjunction with Value Engineering, and like Value Engineering it shows more benefit when it is carried out in the earlier stages of design.

LCC needs to be calculated over a specific building lifetime. For new construction, that timeframe is commonly in the region of 20 to 30 years, although some projects, such as those for hi-tech or other rapidly changing industries, might warrant a shorter period. The life-span used for alteration work would also normally be shorter than that for a new-build project.

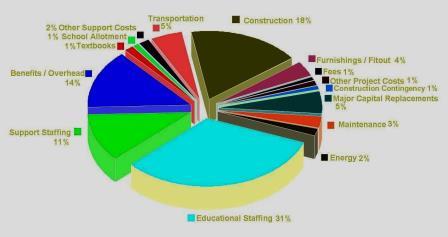

School Life Cycle Costs

To compare alternate designs, the initial cost is one consideration, but ongoing costs, such as maintenance, fuel and energy requirements, periodic replacement costs, and final disposal cost must also be considered. If one design is expected to lead to the users of the building becoming more efficient (for instance, it has been suggested that enhanced air quality and natural sunlight within a workspace can increase an office worker’s efficiency by 10 - 15%) then the cost of staffing the building needs to be included. If a particular design is expected to increase its potential resale value, then that might need to be considered. Costs that remain constant across the alternate designs, such as design fees or permits, would normally not be included in the LCC study. Deciding what scope is to be included in the study is a very important step.

Once you know what items to include, the next step is to arrive at costs for them. The initial construction cost, and any replacement costs for equipment might be fairly straightforward. Assessing the maintenance costs might be a bit more subjective and having historical records can be very handy. Other sources for LCC costs include organizations such as NIST (National Institute of Standards and Technology) which publishes Energy Price Indices and Discount Factors for Life Cycle Cost Analysis.

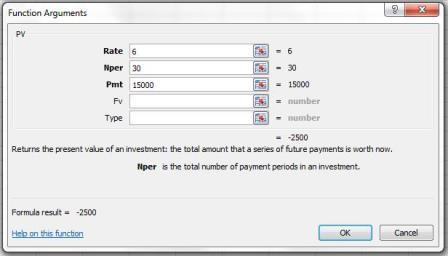

Once you have compiled the costs, you get to the main problem, which is comparing costs that occur at different points in time and at varying frequencies. Inflation is going to increase those costs over time, and there is an ‘opportunity cost’ (the benefit that could have accrued from the money if it had been invested). To resolve these issues there are two related techniques that can be used. The first, and most popular, method is to assess how much you have to invest at a set interest rate now, in order to pay for all the costs that occur over the building’s lifetime. That method is called Present Value. The other method is called the Annual Equivalent Value, and basically assumes you will be borrowing the money to pay for all the costs, and calculates the amount annually to pay off the capital and interest charges on the loan.

Design alternatives are compared against a baseline option, which would normally be the one with the lowest initial construction costs. The comparison of options can then show either the comparative life cycle costs, or it can show the payback time for the other options (how long it will take before lower maintenance and/or fuel costs, etc., makes the costs of an option comparable to the baseline.)

There are many different software applications available for calculating Life Cycle Costs, such as BLCC (from NIST) and LCCP (from the Water Environment Research Foundation). Microsoft Excel has a PV (Present Value) function that can also be used for amounts that occur every year, which uses the formula:.

=PV(InterestRate, NumberOfYears, FixedAmount)

Design consultant: Katie Levine of Vallance, Inc.