Printable PDF version

Subscribe to our newsletter

Generations in Construction

Construction PDF Coalition

Intrigue & Increases

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

www.TBDconsultants.com

With the Boomers starting to retire, the Millennials beginning to outnumber the GenXers in the workforce, and those of Generation Z now starting to enter the workforce, we are seeing changes in work patterns. In this article we look at the generation shift and its effects on the construction industry.

PDF has become a popular format for transferring documents to others, but the types of information that a file contains can vary, affecting its usefulness. Here we look at the PDF Coalition's efforts to bring about consistency with the PDF documents.

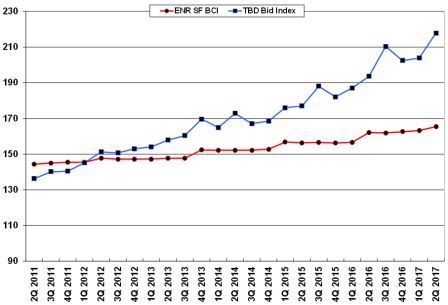

At the time of writing (May 2017), the news out of Washington, DC, has been more on the lines of political intrigue and accusations, rather than word of movement on the promised tax changes and infrastructure initiative. But the economy is still moving along nicely, as shown by the continuing rise in employment levels. Certainly the volume of construction work remains high.

The hot market, and shortage of staff, means that contractors can be selective in what they bid on, reducing the number of potential bidders and increasing bid prices.

The following (adapted from our 2007 Q4 newsletter) summarizes the issues that are driving bid prices up:

It has been established that a reduced number of true bidders results in an increase in bid prices. On average, under normal market conditions, bids can be expected to be up to about 15% higher than estimated where only one or two bids are received. The reduced number of bidders and the increase in bid prices are both reflections of the bidding market.

The industry is experiencing a shortage of skilled workers, due to people having left the industry during the recession. The prevalent, prolonged effect of overtime also has adverse effects on productivity and labor costs. It has been shown that in a period when contractors' work-books are full, prices can be up to 30% or more above the “norm”. While there is undoubtedly a measure of overlap in this issue and the preceding one, they both have measurable effects on pricing levels. This factor will (in general) be consistent across the bid packages, and reflects the added costs of doing business in a busy market, over and above normal escalation/inflation.

Another factor of a strong construction market is that contractors can get choosier about projects, and bid accordingly. Work that is straightforward (e.g. new construction) will attract more attention and have some competition, whereas work that is unattractive will (if bid at all) be priced at a level that covers all current and future risks, and possibly more. Renovation work generally would fall into this “problematic” category for many trades, and the premium (over and above the other premiums) could be up to 50%. This factor will vary, depending on the type of work.

To summarize the above three factors affecting bids, we have the following range of effects:

| Low Range | High Range | |

| Lack of bidders | 0% | 15% |

| Hot market conditions | 5% | 30% |

| Attractiveness markup | 0% | 50% |

| Total effect | 5% | 95% |

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.